To get a complete picture of your business finances, you need a smooth accounts receivable operation.

Unfortunately, many businesses still rely on manual accounts receivable processes, which makes it difficult to gain visibility of the most important numbers.

By automating the accounts receivable process via digital transformation, your business will regain visibility of its finances and reduce the days sales outstanding (DSO).

Cash flow challenges

Manual accounts receivable processes can have a seriously negative impact on cash flow.

Retaining large amounts of allocated cash and open items limits the finance team’s visibility, making the month-end more challenging than it should be.

Late payments only add to the challenge, because they create more work for the finance team.

Add to that the regularity of short payments, out-of-time discount claims, recoverable debts and contract disputes, and you end up with a department that spends more time chasing its tail than being productive.

The importance of a low DSO

Manual document and process management in accounts receivable will adversely affect your business’s days sales outstanding.

The DSO refers to the costs incurred for carrying overdue receivables and helps businesses calculate how long it takes to collect cash from customers.

Without a digitalised accounts receivable process, firms will spend an inordinate amount of time manually chasing payment. Add that to inevitable instances of human error, and achieving a low DSO becomes nothing more than a pipe dream.

The solution: automation

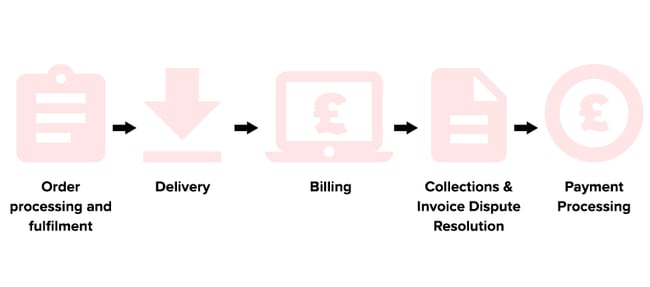

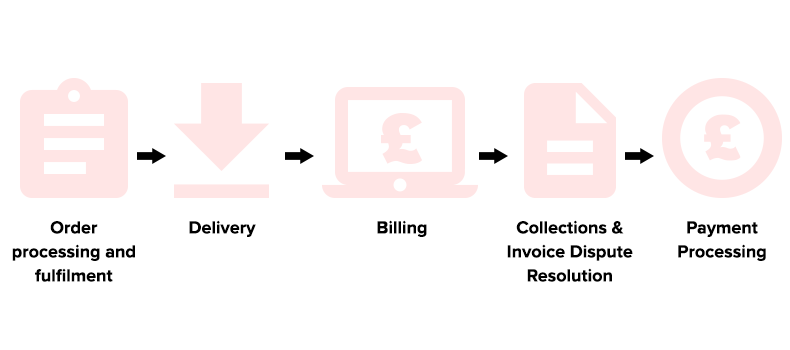

Digital transformation and automation go hand-in-hand.

Modern cash management systems enable businesses to automate the delivery of paper and electronic invoices to customers.

This means customers who are yet to go digital themselves can still benefit from the new system, while those who have embraced e-invoices will still be satisfied.

The same goes for order forms and purchase orders, which can be captured by the automated process and have their information validated before being sent to the back-end system.

A digital accounts receivable process is also capable of capturing payments that enter the business, before grabbing the information contained within remittances. Reconciling payments with open invoices therefore suddenly becomes an entirely stress-free, automated process.

Benefits and workflow improvements

By digitalising back-office processes, you can remove the manual elements that slow down your accounts receivable operation.

This has numerous benefits:

- operating costs are reduced;

- the days sales outstanding is reduced;

- the time taken to settle invoices by customers is shortened and compliance improved;

- accounts receivable information is centralised, with easy access provided to audit trails; and

- data entry errors are reduced.

By automating invoice delivery, collections and payment processing, your business will finally gain a full picture of its finances.